Over many years, incentives such as lucky draws for vehicles, payment of transfer duty for the buyer and other incentives such as rebates have been offered by developers to encourage land sales.

Competition, over-supply and recessions may be real obstacles to selling land stock quickly so incentives and rebates are often seen as the way to secure sales. The benefit of a well-constructed, fair and efficient sales process cannot be understated: it benefits all of those in the supply chain, including buyers. Buyers are able to make some savings and in land subdivisions it is better that the estate is established quickly. Half populated estates will only diminish prices.

Developer Benefit

From a developer’s perspective, incentives and rebates may be a good way to “kick-start” a development in an over-crowded market or, later, to assist in “wrapping-up” a development to move to the next venture.

Buyer Benefit

Consumers of all types of products and services have come to expect a “discount” or other benefit. Buying land is no different. Importantly, being offered an incentive or rebate may be the difference between renting or buying and the dream of owning a home becomes real.

Sometimes it’s thought that rebates or cash-back incentives will help buyers to secure finance. That’s not always the case and this article explores the issues.

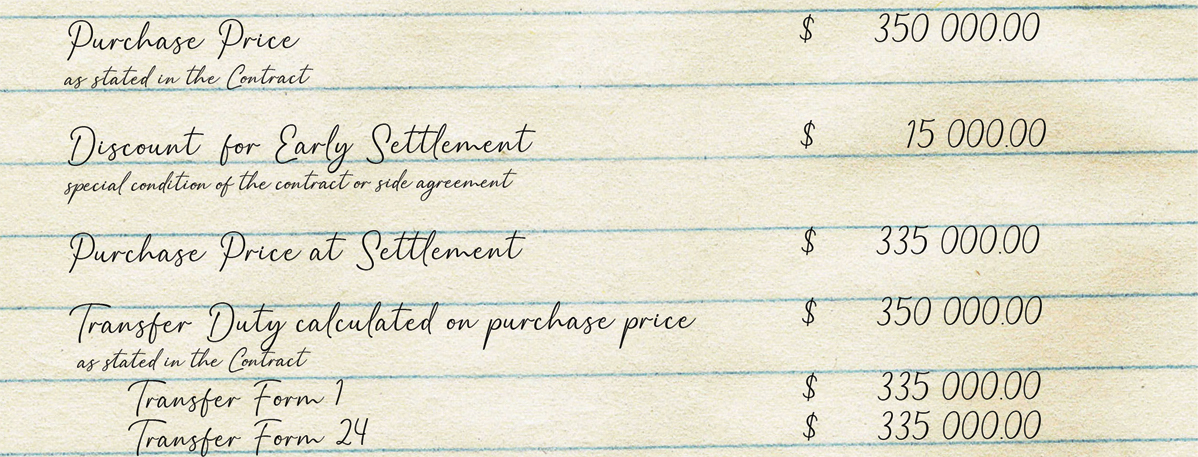

There are some hidden traps. It is important to remember that a rebate does not change the purchase price (but does affect value). Transfer duty is payable on the purchase price disregarding the amount of the discount or rebate. It should also be noted that the property value is recorded in valuation records maintained by the Queensland Government and the actual value is the price on the face of the contract of sale including the discount or rebate. Similarly, a financier may discount in the same way for loan and security purposes.

So, while the property market will always find a place for discounts, rebates and incentives (as it does in the commercial leasing market) this comes with a catch.

A note about misrepresentation

Whilst a rebate might be beneficial for the seller and the buyer, sellers and their agents need to be careful about misrepresenting the purchase price and full disclosure of discounts and rebates needs to be made.

Where offered, these should be covered by including a written condition in the contract. Where a rebate is covered in a side agreement that may also present an issue for a buyer seeking finance.

Failure to inform a financier about an agreed rebate may amount to fraudulent conduct because the true state of affairs has not been made known to the financier. Financiers rely on the terms of the contract between the parties and a buyer has a legal obligation to act in good faith when providing information to a financier when applying for finance.

Government departments such as the Land Titles Office, the Office of State Revenue and the Valuer-General’s office rely on the integrity of sales data. They rely on the purchase price stated on the transfer document lodged for registration as disclosing the true consideration paid.

A further issue about misrepresentation (or misleading and deceptive conduct as it is also known) may occur if potential buyers are led to the wrong belief of land prices in a development.

Our obligation as lawyers

Whilst rebates and incentives may appear to be only matters to concern buyers and sellers, they do present significant issues and special concerns for lawyers acting in transactions where rebates and incentives are offered. This is because of separate and distinct legal and professional obligations placed on lawyers.

This includes disclosure to financiers, ensuring correct and accurate information in the Form 1 Transfer and Form 24 Property Information as a part of the conveyancing process. Whilst disclosure in these forms informs the relevant authorities of the actual price paid at settlement, as mentioned above, it does not remove the responsibility of buyers to pay transfer duty on the full purchase price stated in the contract.

The Queensland Law Society states that if, after a lawyer has explained to their client of possible fraudulent behaviour in not disclosing a rebate or cash-back and a seller or buyer still refuses to properly disclose to the authorities, then the lawyer should cease to act. It’s that simple.

A discount or rebate is not to be confused with an agreed variation or reduction of the purchase price agreed for other reasons, often recorded in a deed or other document after the contract is formed.

E-Conveyancing

The recent introduction of e-conveyancing, electronic transfer and registration of title, does not change the above obligations. Practitioners using e-conveyancing are required to include all relevant information about discounts or rebates in completing the electronic versions of the Form 1 and Form 24 for registration.

Broadley Rees Hogan (BRH Lawyers) is an independent firm, specialising in corporate, commercial, property, construction and litigation. Based in Brisbane, we act for clients across the country and internationally – for an unassuming firm, we know how to deal big.

For more information, please visit www.brhlawyers.com.au or contact us on (07) 3223 9100.

Save as PDF

Save as PDF